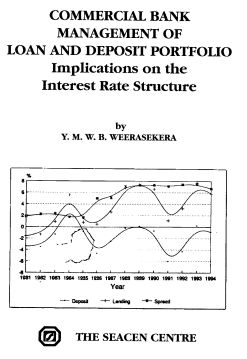

This study is divided into five chapters. Following an introductory chapter the second chapter provides an overview of the commercial banking system and discusses real interest rates and spreads in the member SEACEN countries. The third chapter examines the factors affecting the lending rates and spreads. The profitability of commercial banks is discussed in chapter four. Chapter five reviews the implications for the interest rate structure and offers some concluding remarks.

-

About Us

-

Events

-

Publications

-

About The SEACEN Centre

-

The Centre's Governance

-

Courses